Small and medium-sized enterprises (SMEs) make up the majority of the UK economy and are an essential part of the world we know. In order to be able to fund their operations and growth, enable expansion or provide support in the event of unexpected expenses, SME’s require access to lending that offers them the necessary SME capital.

In today’s day and age, traditional lending processes are becoming slower and tougher as banks tighten their requirements, making them less accessible than they once were. To open up the options available to SMEs, alternative ways of lending have grown in obtainability, but this does not mean there are no obstacles to face along the way.

In this article, the UK SME lending market will be explained, covering key processes as well as potential challenges which may come with such loans. In such an ever-changing industry, the future of the SME lending market will also be discussed.

What is SME Lending

Small to medium businesses are unlikely to have access to large-scale corporate financing options such as syndicated loans, capital markets, and bond issuances. The more traditional corporate financial businesses work with larger enterprises, not offering a suitable solution for smaller businesses who require support when wanting to grow their offering or fund existing operations.

SME lending utilises a tailored approach that takes into account the individual needs based on the scale of the business, acknowledging the risks faced. With such diversity among SME sectors, financial lenders assess the needs of the business differently and are able to offer more specific support such as equipment leasing, credit facilities, and merchant cash advances. Learn more on private money lending and how to become a lender in our helpful guide.

The SME Lending Process

Online SME lending platforms utilise modern technologies that allow businesses to apply for loans and receive an answer within hours. With the advanced systems being able to assess the risk and provide the best solution based on data analytics, traditional lending methods have become outdated.

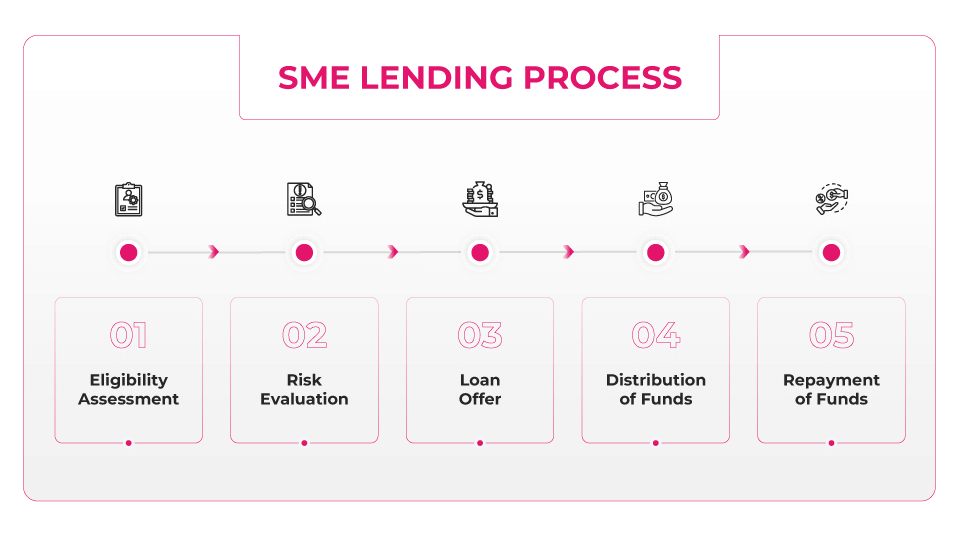

The process of obtaining an SME loan varies from lender to lender but as standard, follows a similar process:

Eligibility assessment

The initial application will require business details such as credit history, a business plan, and financial statements. This will be used to identify the type of loan needed – with solutions varying from short-term working SME capital finance to long-term expansion investments.

Risk evaluation

To assess whether lending to a business provides significant risk to the lender, cash flow, credit rating, and overall financial health will be analysed. Some SME lenders may be willing to accept non-traditional data, such as transaction history, in scenarios where sufficient financial information is not available.

Loan offer

An offer will be provided based on the initial evaluation, allowing the business owner to review the proposed terms and decide whether the lending terms are adequate. This offer will include the loan amount, repayment plan, and SME lending rates.

Distribution of funds

Once a loan has been accepted, the funds will be deposited into the business account. Traditional bank loans are known to take time whereas more current online lending methods tend to deposit the money quickly.

Repayment of funds

As soon as the money has been deposited, the repayment plan will begin and a business will be required to pay back the lender in regular instalments which have been agreed on within the contract.

Challenges in SME Lending

For many small business owners, navigating loans can be a huge challenge as it is unfamiliar territory and the options may appear overwhelming. With so many SME lenders available nowadays, the risk of choosing unsuitable solutions or making misinformed decisions is high.

Another common issue for smaller businesses is the lack of credit history or cash flow. If the business is relatively new or has had limited success, the owner will not be able to provide the potential lender with the level of data they need to willingly lend without substantial collateral.

If a SME is considered high risk to the lender, lending criteria is likely to include higher interest rates to counteract the risk. For the business, the options to borrow become more limited and the costs involved are increased, hindering growth and future prospects. In comparison to traditional loan methods, the money may be accessible faster, but the SME lending rates are going to reflect the level of risk involved.

SME Lending Regulations

Although there may be challenges in SME lending, there is governmental support available within the lending market. The FCA (Financial Conduct Authority) is responsible for ensuring that SME lending regulations are fair, transparent, and responsible. The GGS (Growth Guarantee Scheme) was launched on 1st July 2024 and was designed to support access to SME finance in the UK, supporting facility sizes of up to £2m.

Conclusion

The SME lending market continues to evolve as online platforms provide more accessible financing options to small and medium businesses who need to invest into their growth and manage cash flow. With a wide choice of lenders available nowadays, as well as government support initiatives, the future of the SME lending market in the UK appears positive.

For businesses seeking reliable financial support, MHG Capital focuses on providing asset backed funding to SMEs within the UK. With an aim to generate returns for all stakeholders, a tailored solution is found for each client to maximise value. Learn how SME lending can be important for diversifying your portfolio and get in touch and schedule a call for more information.