In today’s fast-paced world, private money lending is emerging as a powerful tool to build wealth, influence the business world, and make an impactful difference in economic growth. But could you step into the role of a lender?

What is a private lender?

Private lenders are individuals or entities who provide loans outside traditional financial institutions. With higher interest rates and flexible lending criteria, they play a vital role in fuelling business expansion, job creation, and innovation.

If you’re considering becoming a private lender, you’re looking at a potential for strong financial returns, increased control over your investments, and the opportunity to positively impact businesses. But before you jump in, there’s a lot you need to know which we’ll explain in this article.

Benefits of being a private lender

- Attractive returns: as a private lender, you earn interest income on your loans, often at higher rates than traditional bank savings or investments.

- Diversification: you can choose to lend in various markets, such as real estate, SMEs, or personal loans, allowing you to mitigate risk & take advantage of growing niches.

- Control and flexibility: you decide who to lend to and set your own terms, giving you more control over how and where your money is invested.

- Positive economic impact: you help businesses access crucial capital, driving economic activity, fostering job creation, and enabling innovation.

Before you get started

- Understand the legal landscape

Before you start lending, familiarise yourself with the UK lending regulations, particularly the need for FCA approval when lending to private individuals for non-business purposes. For business loans, however, regulation is typically less stringent. - Assess Your financial situation

Know how much capital you’re willing to lend and define your risk tolerance. Create a business plan outlining your lending strategy, target market, and risk management approach. - Choose the right type of loan

Consider the different types of loans and businesses that might align with your goals.

What are the different types of business lending

Businesses have a wide range of requirements when it comes to loans. Some may need short term capital, others may need regular or ongoing credit.

They can be broken down to the following:

- Term Loans are fixed-term loans with regular repayments, often used for capital expenditures or long-term projects.

- Working Capital Loans are designed to meet short-term financing needs, such as inventory purchases or payroll.

- Overdraft Facilities are very flexible lines of credit that allow businesses to get funds as needed, up to a pre-approved limit.

- Equipment Financing loans are specifically designed for purchasing machinery, equipment, or vehicles.

- Invoice Factoring is a financing option whereby a lender purchases a business’s invoices at a discount, in return for immediate cash flow.

What are the different types of lender

There are many different kinds of lender – money lenders, loan lenders, private lenders, and mortgage lenders. These terms may sound interchangeable to you, but each represents quite a distinct type of lenders, with its own specific functions.

-

Money Lenders

This is quite a broad term that encompasses a number of types of lenders, including banks, credit unions, and non-banking financial companies (NBFCs). Money lenders offer a wide range of financial products, such as loans, credit cards, and mortgages.

-

Loan Lenders

This term is often used interchangeably with money lenders, as it refers to any entity that provides loans. Loan lenders can be banks, credit unions, online lenders, or even individuals.

-

Private Lenders

These are individuals or entities that provide loans outside of traditional financial institutions. They often charge higher interest rates but may be more flexible with their lending criteria, making them an option for borrowers who may not qualify for traditional loans.

-

Mortgage Lenders

This specific type of lender specialises in providing loans for the purchase of real estate. Mortgage lenders can be banks, credit unions, or other financial institutions. They offer various types of mortgages, such as fixed-rate, variable-rate, and interest-only mortgages.

What are the key differences?

- Scope of services: Money lenders offer a wide range of financial products, while mortgage lenders specialise in home loans.

- Regulations: Mortgage lenders are typically subject to stricter regulations and oversight than other types of lenders.

- Interest rates: Interest rates can vary depending on the type of lender and the specific loan product.

- Accessibility: Private lenders may be more accessible to borrowers with less-than-perfect credit, but they often charge higher interest rates.

What you need to know about private lending

As a private lender, you have a few critical responsibilities to ensure success and legal compliance:

- Due diligence: Always conduct a thorough assessment of a borrower’s financial health before lending.

- Fair lending practices: Follow anti-discrimination laws and ensure transparency in loan terms.

- Compliance: Stay updated with the necessary regulations, licensing, and consumer protection laws.

- Risk management: Implement strategies to mitigate the risk of loan defaults and protect your investment.

- Customer service: Maintain clear communication and be responsive to borrower inquiries.

Do I need FCA approval?

Whether or not you need FCA approval depends on the type of lending you plan to do. Loans to individuals for personal (non-business) purposes are regulated by the FCA, meaning you’ll need authorisation to proceed. Loans to businesses and sole traders for business purposes are not regulated, so FCA approval isn’t required in these cases.

Opting for FCA approval, even if it’s not legally required, can enhance your credibility and mark you as a professional. However, it also adds complexities and administrative demands. Assess carefully whether the benefits of voluntary regulation align with your goals and resources before deciding if it’s right for you.

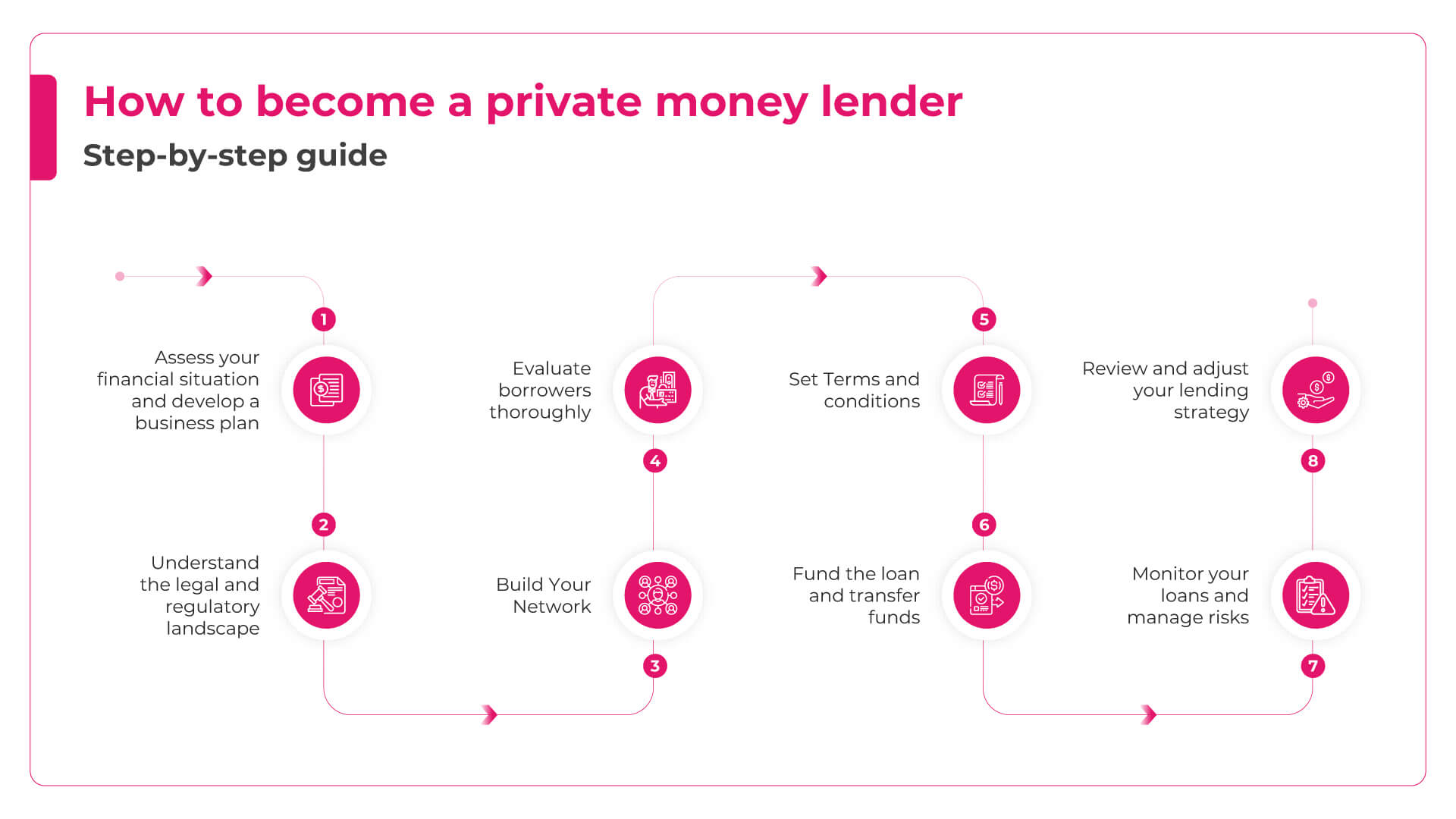

How to become a private money lender: step-by-step guide

1. Assess your financial situation and develop a business plan

- Evaluate your capital: Determine how much capital you have available to lend and how much you’re willing to risk. This will form the foundation for your lending capacity.

- Define your risk tolerance: Consider how much risk you’re comfortable taking on. Different loan types and borrower profiles come with varying levels of risk.

- Outline your lending strategy: Identify your target market, such as real estate investors, small business owners, or short-term borrowers. Define your lending criteria, interest rates, and preferred loan terms.

- Plan for risk management: Decide how you’ll mitigate potential losses, such as by requiring collateral or spreading your investments across multiple loans. Establish procedures for dealing with defaults.

2. Understand the legal and regulatory landscape

- Research local lending laws: Familiarise yourself with local regulations and licensing requirements. In the UK, for example, loans to individuals for personal purposes require FCA authorization, while business loans generally do not.

- Consider consulting an attorney: To ensure compliance and protect your interests, you may want a legal professional to draft or review loan documents.

- Create standardised loan documents: Develop clear, enforceable loan agreements that outline all terms and conditions, interest rates, repayment schedules, and collateral requirements.

- Plan for regulatory changes: Regulations can change, so stay informed to maintain compliance as laws evolve.

3. Build Your Network

- Connect with potential borrowers: Building relationships with real estate investors, small business owners, and other potential borrowers is crucial. Attend industry events, join lending forums, or connect with borrowers through social media platforms.

- Collaborate with industry professionals: Develop partnerships with real estate agents, mortgage brokers, and financial advisors who can refer clients needing loans.

- Explore online lending platforms: Consider using online platforms that connect private lenders with borrowers. These platforms can expand your reach and help you find more lending opportunities.

- Maintain strong professional relationships: Your network can be a valuable source of referrals and insights. Regularly communicate with key contacts to stay informed on new opportunities.

4. Evaluate borrowers thoroughly

- Assess creditworthiness: Review the borrower’s credit history, financial statements, and debt-to-income ratio to gauge their ability to repay.

- Examine assets and income: Look at the borrower’s assets, income stability, and financial obligations to understand their financial health.

- Understand the purpose of the loan: Knowing why the borrower needs the loan can help you determine its risk profile. A loan for real estate investment, for instance, may come with different risks than one for business expansion.

- Require collateral when necessary: Consider securing your loan with collateral, such as real estate or equipment, to minimise potential losses if the borrower defaults.

5. Set Terms and conditions

- Negotiate loan terms: Discuss and finalise terms with the borrower, including loan amount, interest rate, repayment schedule, and any fees.

- Establish repayment schedules: Clearly define how and when repayments will occur. Options may include monthly payments, interest-only payments, or a balloon payment at the end of the term.

- Determine interest rates: Set an interest rate that reflects the level of risk and aligns with your financial goals. Private loans often carry higher rates, but they should still be competitive.

- Document everything: Make sure all terms are thoroughly documented and signed by both parties. Clear documentation protects you legally and minimises misunderstandings.

6. Fund the loan and transfer funds

- Confirm borrower agreement: Once terms are agreed upon and documents are signed, ensure that both parties understand the repayment process and expectations.

- Disburse funds: Transfer funds securely to the borrower’s account, adhering to any regulatory requirements or procedures for tracking financial transactions.

- Set up tracking and monitoring systems: Use software or spreadsheets to track payments, due dates, and outstanding balances for each loan.

7. Monitor your loans and manage risks

- Track repayments: Stay on top of repayment schedules and monitor your borrower’s adherence to the terms. Use automated reminders to notify borrowers of upcoming payments.

- Address late payments quickly: If a borrower misses a payment, follow up promptly to understand the issue and determine if a revised payment plan is needed.

- Implement risk mitigation strategies: If a loan shows signs of trouble, consider options like restructuring the loan or increasing collateral requirements.

- Enforce your terms when necessary: If a borrower consistently fails to meet terms, be prepared to take action, whether through renegotiation or pursuing legal recourse.

8. Review and adjust your lending strategy

- Analyse loan performance: Regularly review the performance of your loans to see if they’re meeting your financial goals and risk expectations.

- Refine your strategy: Based on your experience, adjust your approach to target more profitable opportunities or mitigate risks.

- Stay updated on market trends: Changes in the economy, interest rates, and borrower needs can all impact your lending strategy. Keep learning and refining your approach to stay competitive and effective as a private lender.

Conclusion

Becoming a private lender isn’t just about providing capital, it’s about gaining control over your investments, building wealth, and contributing to business growth. With the right strategy, strong due diligence, and a commitment to ethical lending, you can open doors to lucrative opportunities that align with your financial goals.

While private lending does require careful planning and knowledge of the industry, the benefits – flexible terms, attractive returns, and the chance to make a real impact – can be highly rewarding. Remember, each loan you make is more than just a transaction; it’s a chance to help businesses reach new heights while growing your own wealth.

Take the time to build a network, understand your borrowers, and stay informed on lending laws. With patience and the right approach, private lending can be a powerful path to financial growth and personal fulfilment.

Get in touch today to discuss funding investment opportunities with MHG Capital.